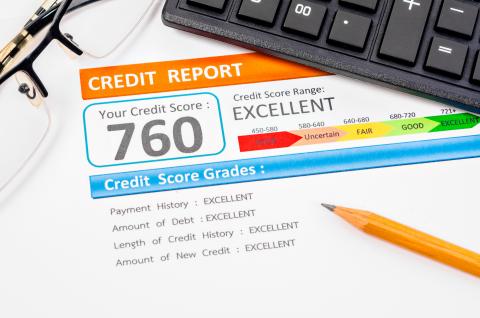

Credit scores can often be a mystery to the general population. Knowing what you can do to increase your score is a goal of many. Average scores are around 670-739 and that is a good rating with the credit bureau. Scores higher than 740 are usually considered very good and scores over 800 are in the exceptional range.

Why do you Need Good Credit?

People often wonder why you need a good credit score and what level will get them what they desire in life. Without good credit, you may not be able to purchase a vehicle or a home. Good credit lets the lenders know that you are going to pay your debt and that you are a responsible person when it comes to money. If you are lacking credit, it is similar to a negative credit score. You are an unknown to the credit companies and this means you are a risk. Building credit is the best way to show them the responsible person you are.

How is your Credit Calculated?

Credit is calculated with several variables, which we have broken down here:

- 35% of your credit is based on payment history and ensuring that you are repaying your debts on time.

- 30% of your credit score is based on credit utilization. This score calculates how much debt you carry compared to your credit limit.

- 15% of your credit score is based on length of credit history. This gives the credit age you’ve had on active credit accounts.

- 10% of your credit score is based on the variety of your accounts and types of credit you have, including cars, houses, credit cards, and other types of loans.

- 10% of your credit score is based on credit inquiries. This shows the number of inquiries that are being made to your credit profile. If you have excessive credit inquiries that will lower your score because it looks as if you are trying to borrow more money.

Building Credit

Check your Credit

The first step of building or rebuilding your credit is to actually know your score. You can check your credit score yearly through annualcreditreport.com for free. It gives you all three credit bureau reports including Experian, Equifax, and TransUnion. Knowing your credit is half the battle and then checking your credit to ensure that is accurate is also necessary.

Fix Errors

If you find any errors, contact the particular credit bureau and dispute the record they have posted on your account. This process can take a while, but it is imperative that you stay on top of all credit dings. A credit monitoring service is a great investment to keep you apprised of any new activity on your accounts.

Payment History

This is the highest chunk of your credit score, so make sure you are keeping up with payments, even if it is only the minimum payment. Late payments can severely damage healthy credit scores. Also, keep your oldest credit card active to show a longer credit history.